We have a long-term interest in innovation, disruptive technology, and the entrepreneurs that lead their companies from early stage to sustainable growth. We have been operators in building technology products, teams, and companies since the early days of the internet and in the technology sector for over twenty-five (25) years, and pursuing innovative and scalable technology companies for strategic investments; opportunities that converge leading-edge technology and meaningful purpose together to create enduring products and services that make our lives better and our world safer for generations.

The meaning behind "inhite" — \ in·hite \ — ˈ [ in ]·[ h AY t ] ˈ — we are into high tech ventures, and we make investments in healthcare innovation and technology endeavors, targeting Healthcare Artificial Intelligence (AI) growth startup companies.

@inhite, we are focused on supporting creative founders, entrepreneurs, that are inspired by innovation and technology and can innovate technology products that can provide efficient and effective services to market while generating sustainable and ongoing growth for years to come.

Having been there and done that ourselves, we add operating experience and strategic capital to portfolio companies. We seek to support founders who are building scalable companies that possess recurring revenues, strong technical barriers, and competitive advantages in the market in which the teams possess the driving force and in sync with us through the process.

The selected companies are shown above.

Entrepreneurs

Entrepreneurs with innovative technology products that make the world turn are the backbone of our society. Those founding entrepreneurs are innovators. We seek outstanding founders to work with us to make the world go round, improving our lives, our health, well-being, and longevity through healthcare AI technology and innovation.

To get to know the founders and their vision, we ask, what are you seeking to achieve with your product and startup company? And what is your offer — the investment opportunity you are presenting?

Tell us your startup story by submitting your pitch deck and or executive summary on your deal.

Pitch Deck

See below for suggestions for your pitch deck. It is an initial document that initiates the talk on your startup company. We prefer a pitch deck versus an executive summary.

In keeping some consistency, your pitch deck should flow, presenting a story about your company. The reading of your pitch deck should include the following twelve points:

![]() Sample: PDF pitch deck suggestion template.

Sample: PDF pitch deck suggestion template.

Equity

After reviewing your pitch deck to familiarize your business model and customer value propositions, we will then contact you for additional documents for our due diligence process. Our deal flow starts in early growth stage rounds near the $1 to $10 million range and may consider late seed equity rounds with a proven concept and traction having at least a $10 million valuation.

Stage

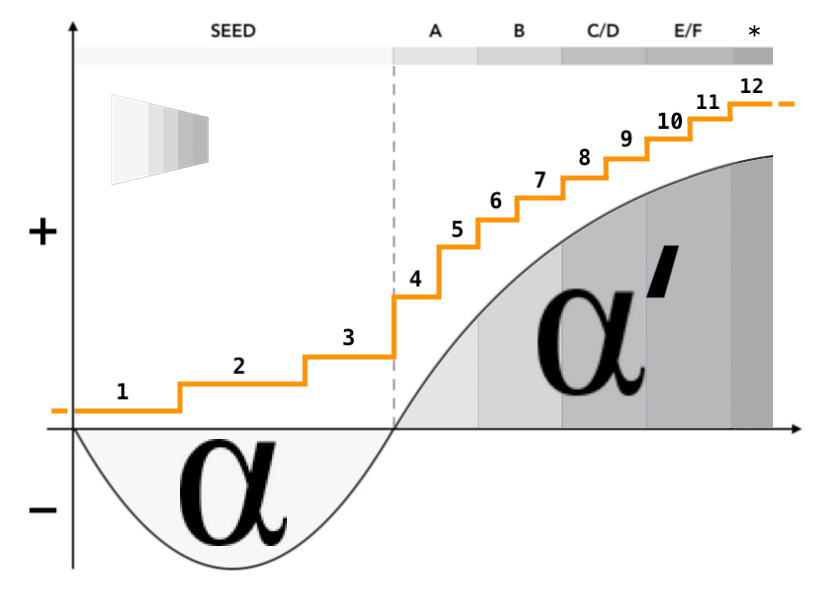

Image: Seeking for Alphas | The Alphas (α, α′).

Series ranging from 1 to 12, each step/stage is specific in need of a capital raise but not necessarily to each alpha (α, α′) company.

The above mentioned is a general progression of a startup company going through the funding rounds and not intended to be specific to your company's funding situation. Let us know where you are in your capital raise, and also go over our pitch deck template for a general overview of each expected slide. Looking forward to hearing from you.

Team

|

|

|

|

Investor

For accredited investors seeking for an attractive financial return on investment, you can contact us at investor@inhite.com

Contact

We seek for α and α′ companies and look forward to hearing from you: ventures@inhite.com.

Copyright © 2025 Jones Funds. All rights reserved.